Malpractice investigation in municipalities and county municipalities

In collaboration with Opinion, we have carried out a survey to map the spread of and attitudes towards financial crime in municipalities and county councils. The field work was carried out by Norstat AS in the time period 6 - 12 May 2020. Carried out by Opinion for Advokatfirmaet Erling Grimstad AS and Inyett AS

The target group for the survey was the following: Municipal director (councillor), directors (municipal directors at a level below the municipal director (councillor), finance or accounting manager or equivalent in municipalities and county councils.

About the selection

- The distribution of which roles the interviewees had is shown in the diagram below

- The interview was conducted by telephone and lasted 3-4 minutes per interviewee

Those who were interviewed:

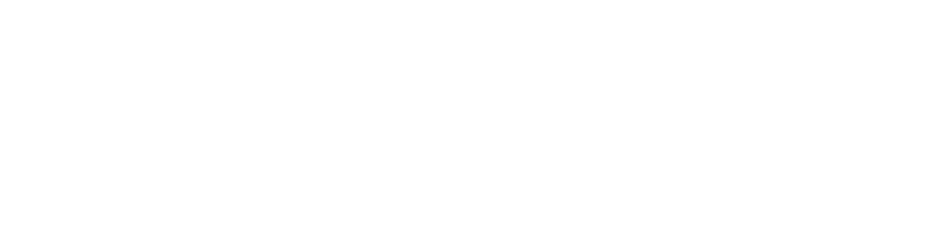

Which tools are used to prevent financial crime?

All have drawn up ethical guidelines in the workplace, but the few have done the same with indicators for identifying economic crime

Question: Does your workplace have a program to prevent economic crime?/ Are you aware of whether any risk assessment has been prepared to map the risk of economic crime at your workplace?/ Are you aware of whether any indicators have been prepared to identify whether Does financial crime happen at your workplace?/Have ethical guidelines been drawn up at your workplace?

Some findings:

Almost all interviewees state that the workplace has drawn up ethical guidelines. When it comes to other preventive measures against economic crime, however, the support is not as high:

- Half of the workplaces have a program for prevention

- 6 out of 10 have prepared a risk assessment for financial crime

- Only 1 in 4 is aware that indicators have been drawn up to identify whether financial crime occurs in the workplace

- If we look at the differences between the roles, there are significantly more municipal directors or councilors who state that they have preventive measures in place:

- 68% state that they have a program

- 82% are aware that a risk assessment has been prepared

- 36% are aware that indicators have been drawn up to identify economic crime

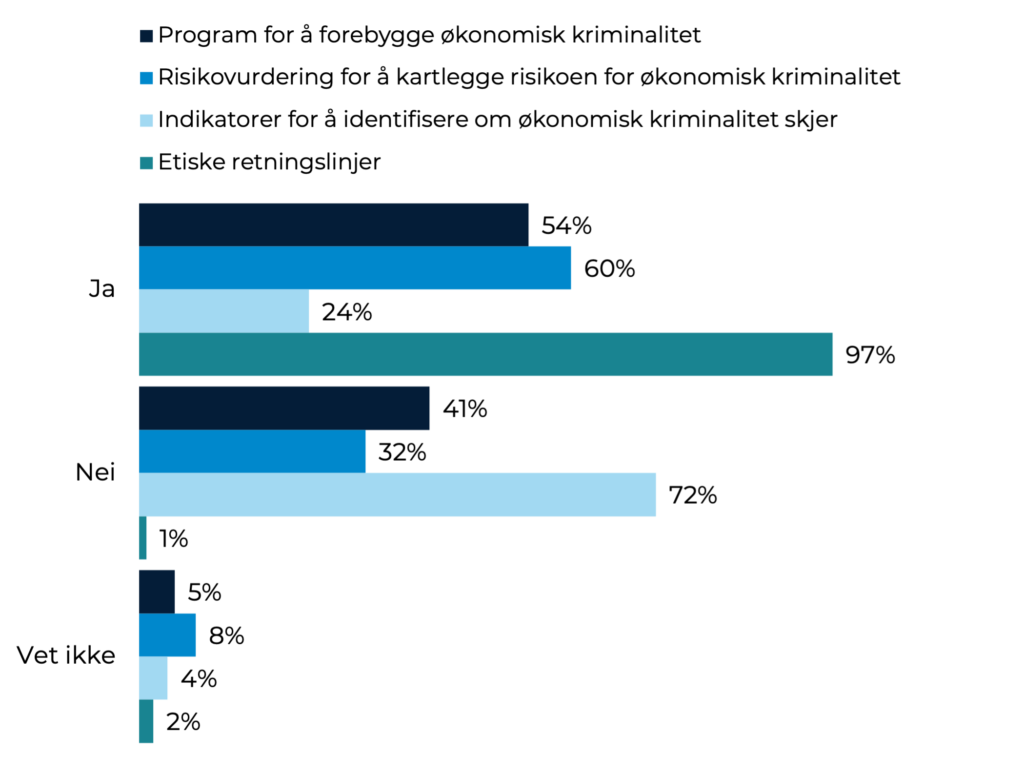

External fraud attempts:

Almost half have experienced external fraud attempts in 2019, in addition 1 in 10 have suspected this

The question the participants answered: Has your workplace been exposed to external fraud attempts in 2019? / If your workplace has been exposed to fraud or attempted fraud, have such cases had a link to suppliers that your workplace has used?

Some findings:

A total of 56% state that the workplace has either been exposed to external fraud attempts or that this has been suspected. In addition, 12% state that they do not know.

Of those who state that external fraud has either occurred or was suspected, 7% respond that the attempted or suspected fraud had a connection to an existing supplier. 8 out of 10 state that there was no link to existing or former suppliers, while 13% do not know.

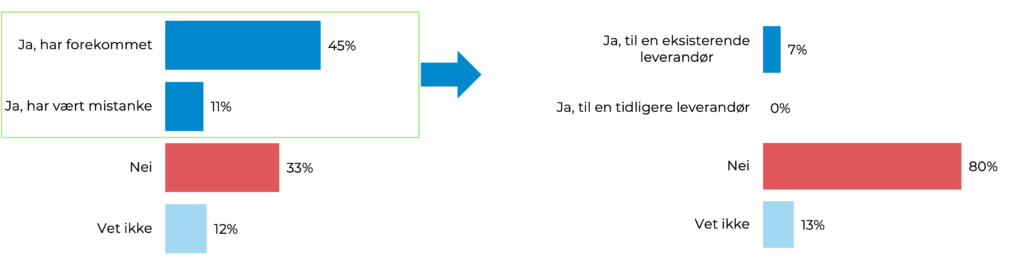

Internal cases of financial crime:

7% experienced internal cases of financial crime in 2019

The participants answered the following questions: Has your workplace been exposed to internal cases of financial crime in 2019?

Some findings:

7% have experienced that there have been internal cases of financial crime last year - in addition, 9% are unsure about this.

Some of the answers to the last question indicate that this is also an element of concern for some - cash registers and the possibility that internal people can change invoices are stated risks.

Few report the conditions:

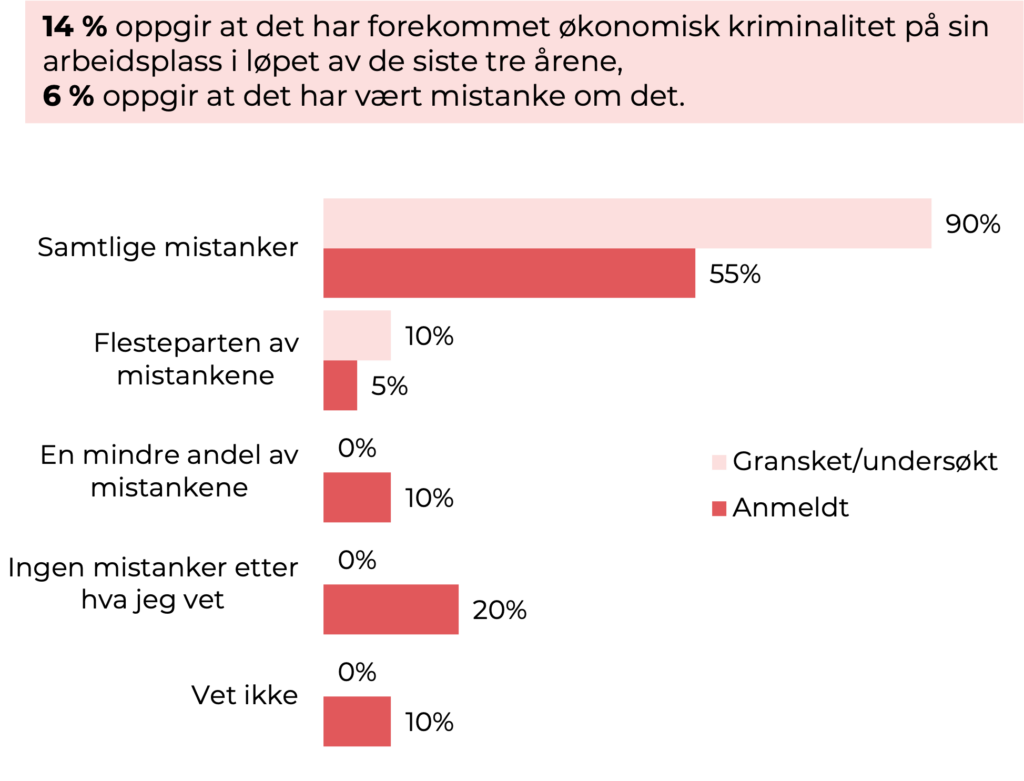

2 out of 10 state that financial crime has either occurred or been suspected in the workplace in the past three years

The question the participants answered: As far as you are aware, has there been financial crime or was there a suspicion of such in your workplace during the last three years? / Approximately what proportion of the suspicions of financial crime in the past three years have been investigated or investigated? / Approximately what proportion of the suspicions of financial crime in the past three years have been reported to the police?

Some findings:

In total, 2 out of 10 state that there has either been financial crime, or there has been suspicion of this, in the last three years. Of these have:

- 9 out of 10 investigated or investigated all cases, while the rest investigated or investigated most of the suspicions

- When it comes to reports to the police, the answers are more scattered; 2 in 10 have not reported any of the cases, while 1 in 10 have reported a smaller proportion - but the majority report all of the cases to the police (55%)

There are no significant differences between the roles of the interviewees or whether they have experienced external fraud attempts or internal financial crime in the past.

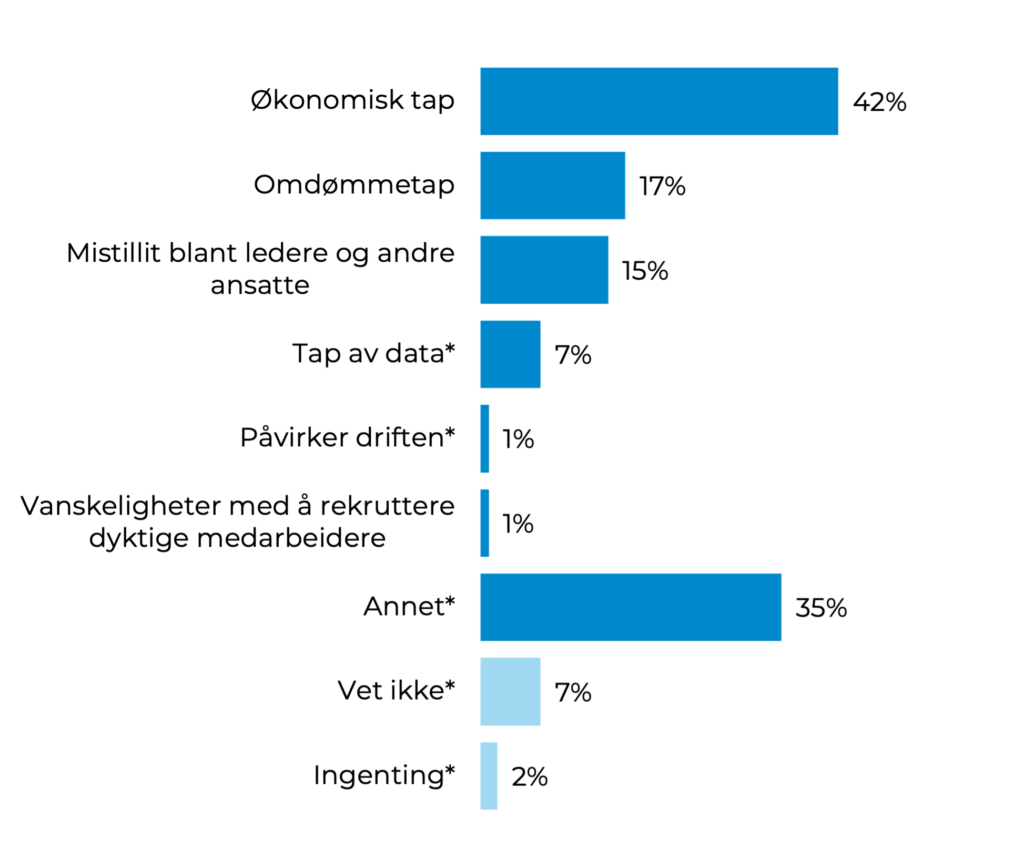

The biggest risks resulting from financial crime:

Financial loss is perceived as the biggest risk, followed by loss of reputation and distrust – 7% are also worried about data loss

The question participants answer: What do you think are the biggest risks for your workplace as a result of financial crime?

Some findings:

Financial loss is what a large proportion experience as a risk as a result of financial loss

- The proportion who perceive this as a risk is higher among financial or accounting managers (62%) compared to municipal directors or councilors (18%)

In addition to the financial aspect, it is reputation that is felt to affect the most, together with mistrust among managers and employees. Loss of data was not on the list that could be ticked off, but still 7% state that this is unhelpful.

The variables marked with * are coded based on open responses. The 'Other' field consists of answers that explain which risks are greatest in the workplace (e.g. cash register or invoice fraud).